Semantics and Recessions

Playing the game of semantics is a tight-rope walk over hell with every breath a strong gust of wind both fanning the flames and upsetting the walker’s balance. When Slick Willie tried his hand at semantic reasoning to the grand jury following the Monica Lewinsky affair (pun intended), arguing that his guilt “depends on what the meaning of the word ‘is’ is”, he made himself the fool and crushed his credibility. Later that day, when he later made a statement to the American people saying he answered the questions “truthfully”, it was well understood that he did not regret months of lying, rather, his only regret was getting caught.

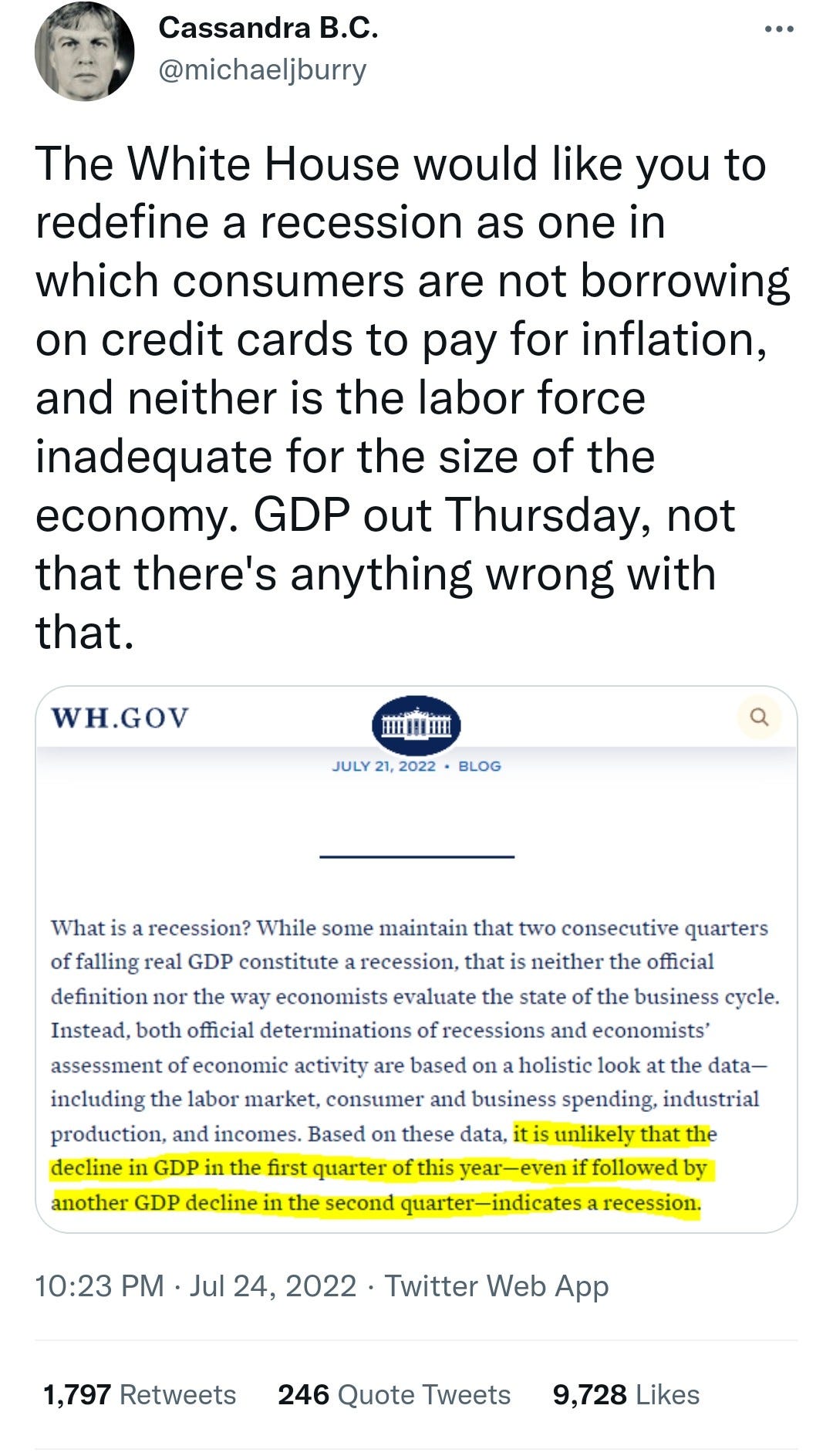

Late last week, the current White House also tried their hand at semantics by questioning the meaning of a recession. It is widely understood that tomorrow, when the second-quarter GDP estimates are released, there will be a second period of negative growth. Apparently, the White House’s strange statement is an attempt to get ahead of the numbers and prevent misinformed reporters from running stories about America being in a recession. By stating that two consecutive quarters of negative growth is not the “official” definition of a recession, and citing the (private nonprofit entity) National Bureau of Economic Research as the “official recession scorekeeper”, the goal is to cover the veil over the public’s eye with yet another appeal to authority.

Funny enough — I agree that two quarters of negative growth is a terrible definition of a recession. Recessions can happen much quicker than that as we saw with the government induced recession in 2020. Furthermore, the idea that the perpetual growth using a poorly calibrated metric like GDP is preferable has always bugged the hell out of me. We can certainly be in a prolonged period of decline while maintaining positive “growth”. If, for example, government spending increases, regardless of what the increases are on, then GDP increases.

Frédéric Bastiat in one of the seminal essays on economics That Which Is Seen, and That Which Is Not Seen, written long before GDP as a metric existed, noted that “The sophism which I am here combating will not stand the test of progression, which is the touchstone of principles. If, when every compensation is made, and all interests are satisfied, there is a national profit in increasing the army, why not enroll under its banners the entire male population of the country?”. Here Bastiat is mocking the government that would make people do useless work, paid for on the taxpayer’s dime, for the sake of keeping people working. Or as he later remarks “digging ditches then filling them in”.

While he is making an argument about opportunity costs, under the belief that people would otherwise find other professions, there is a different route to go with this argument in the GDP-era. We could say, for example: If, when every compensation is made, and all interests are satisfied, there is a national profit in increasing the GDP, why not let the money printers go BRRRRR and finance more government spending? Since the government also controls the commonly used inflation metrics, even “real GDP” growth would always increase this way. You get my point?

So while I would agree that defining a recession as two quarters of negative growth is ill-founded, I reject the premise that, as the White House argues, “there is a good chance that the strength of the labor market and of consumer balance sheets help the economy transition from the rapid growth of the last year to steadier and more stable growth”. The strong growth, as it were, came on the back of pointless government stimulus spending that ultimately went to the pockets of well-connected special interests, which too-often cross familial lines.

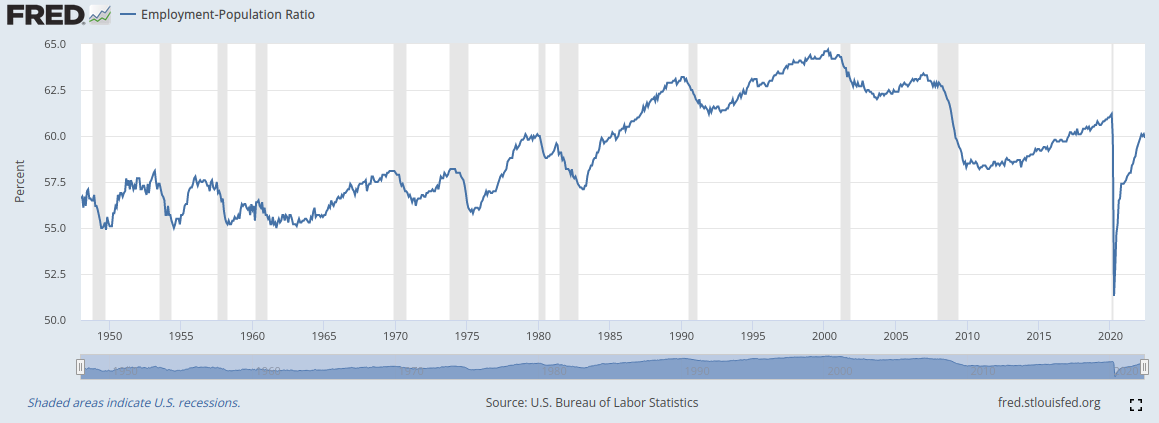

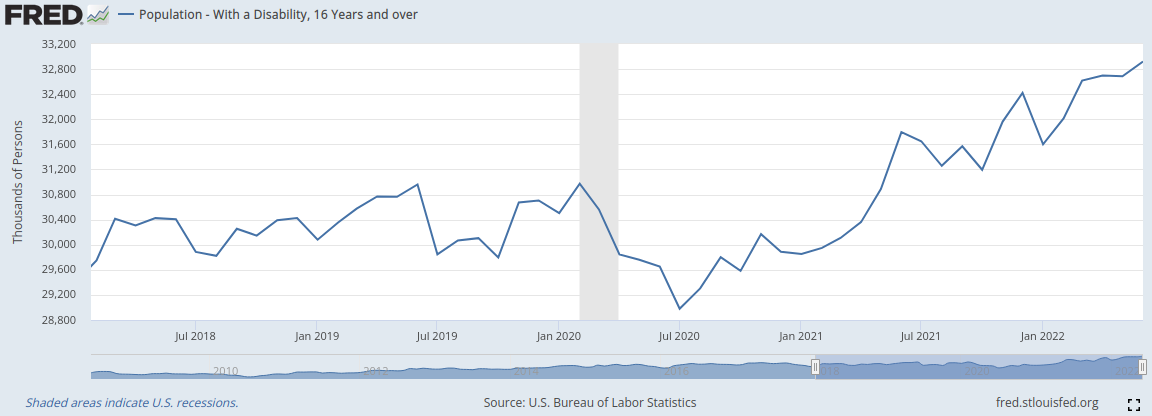

More broadly, the economy, in a sense, was recovering after the government induced recession, but it doesn’t appear to be going back to the pre-lockdown levels and may never under Biden. The “strongest labor markets on record” are an illusion. Employment levels have not recovered and appear to be stagnating. It also appears many workers are not going to re-enter the labor force with questions being raised about whether the record number of people with a disability is vaccine related.

But while I’m sure the jobs being created in “strongest labor market on record” are of the upmost quality, I find it interesting that median weekly real earnings have fallen back to pre-Trump levels and the number of multiple job holders is at an all-time high.

But worrying about people working more and making less is not an indicator the White House cares about. Instead they’ve cited the “Sahm rule” — a “widely cited indicator” that no one has ever heard about and is certainly not commonly used in economic circles. If you ignore the only reason anyone cares about recessions and the reason we have a word to define it in the first place, that is to say widespread decreases in the standard of living, then you can define a recession as whatever you want. What would the key to never having a recession then be? Simply designate a body as the organization that “officially” declare a recession and then have them never declare a recession. This avenue has the advantage of allowing the people looting the economy the perfect smoke screen to continue looting the economy and we’ll be none the wiser, right?

The fact of the matter is there will be plenty of economists that do take the White House’s line of thinking at face value. Economists generally don’t agree on anything. That’s part of what makes the semantics argument tenable here, yet what means it must ultimately fail the test in the free market of ideas. There will be those who won’t see the signs of a recession until the financial markets are on fire and the western world is bankrupt and begging for bailouts. However, some will lead the way in signalling the alarm…